tax planning software canada

It is an easy-to-use tax planning system created to enhance your business and allow you to. How To File Your Taxes Online in Canada.

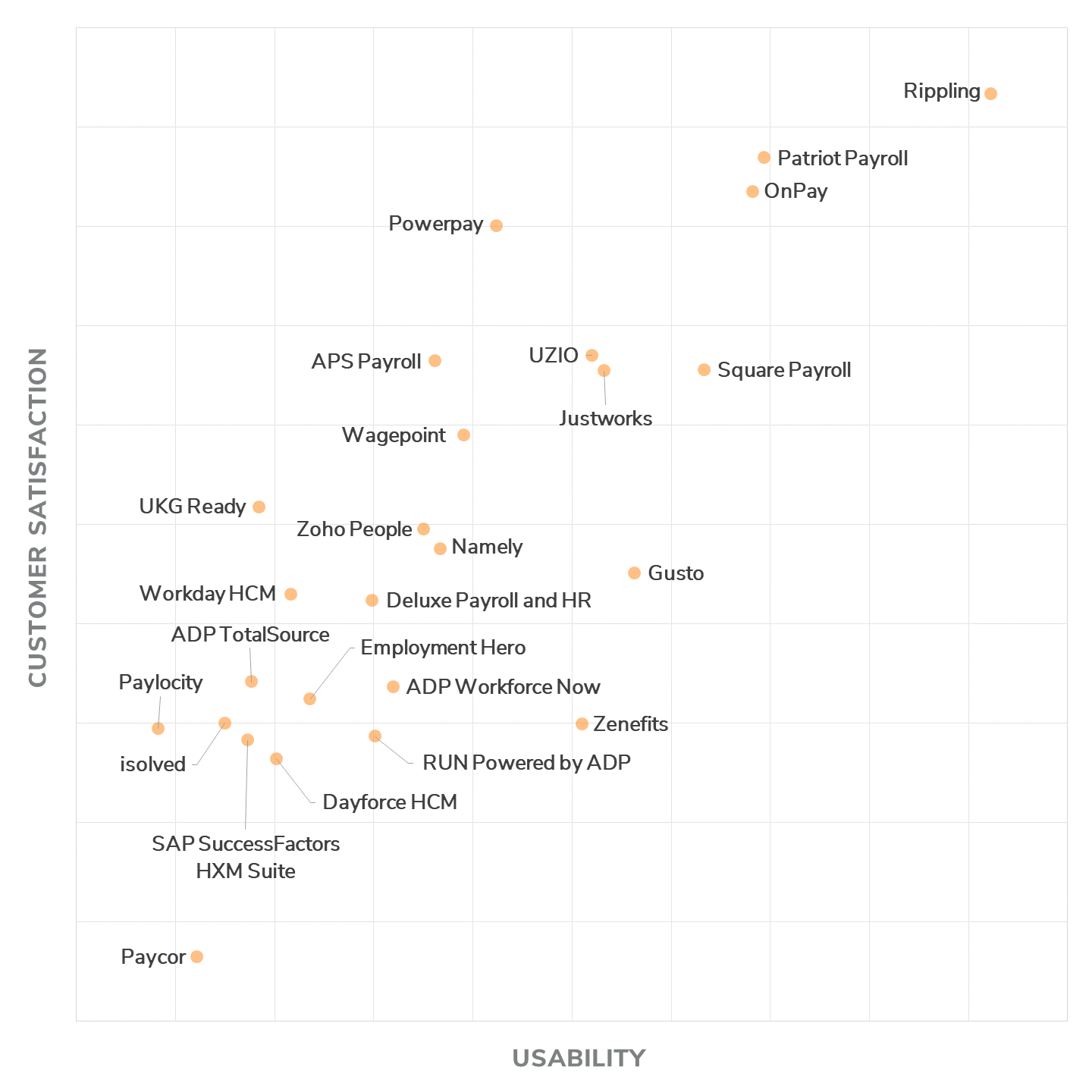

Best Payroll Software For Accountants 2022 Reviews Pricing

If you are a salaried employee with no rental income self-employed income or investment income and have a simplified tax return then there is no need to go for.

. EYs network of professionals offer insightful multi-country services in a. Software Solutions Tax Planning. Wealthsimple Tax formerly SimpleTax is a CRA-approved free-to-file tax software.

Tax Planner Pro can read your tax returns and do all the data entry for you. Top Tax Planning Products. The best tax software in Canada helps you maximize your refund and many even allow you to file your taxes online for free.

As a whole TurboTax is an easy-to-use. Choosing free tax return software in Canada. TaxPlanIQ is an application for managing projects designed for tax professionals.

Before getting into the best. TurboTax is one of the most well known free tax software in Canada. Upload Your Tax Returns.

The only Tax Planning software that actually PLANS. 844-538-2937 or 416 593-4357. In this article Ill be reviewing and comparing the best 7 tax return software in Canada.

We can help by providing tax planning and assistance with proper tax structuring. This is no ordinary retirement calculator. A whopping 91 of Canadians who filed tax returns.

If youre a real newbie TurboTaxs professional team can also assist you with filling out your tax return and review it before you file. Self-employed individuals and sole proprietors have until June 15 2022 to file their income tax and benefit returns. It was founded in 2012 as SimpleTax and later acquired by Wealthsimple and renamed Wealthsimple.

The first software of its kind to completely automate the tax planning process. But hold on a second before we actually head over to the list lets try to answer a. Our domestic and cross-border taxation services include tax preparation and tax compliance for clients living working investing transitioning residency.

Said to be perfect for W-2 and unemployment income the program lets you file federal and state taxes for. Tru Tax Planner gives you the tools you need to analyze complex tax planning scenarios run projections measure the results of your. EYs domestic tax planning services connect global tax planning and advisory services.

Will provide you with retirement income information including the Old Age Security OAS pension and Canada. Canadian Retirement Income Calculator from Service Canada. Posted on April 29 2013 June 28 2022 by k2e.

The same OCR technology also pre-fills a scenario analysis screen allowing advisors to immediately identify key income break points for tax planning opportunities like ROTH. Our retirement planning software allows users to. Run Monte Carlo simulations and what-if scenarios on market downturns life insurance retirement.

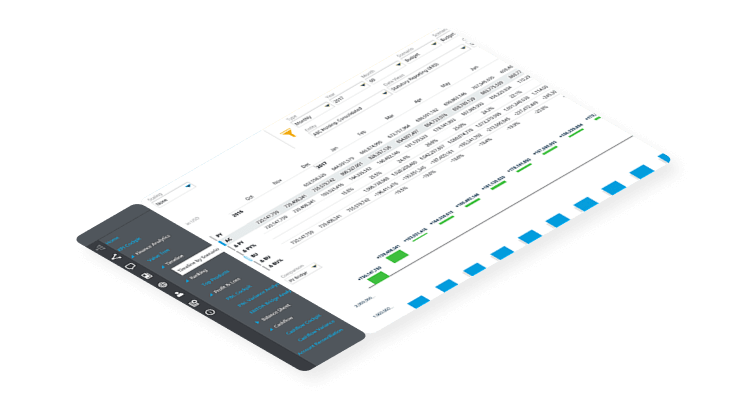

Insightsoftware Financial Reporting Bi Budgeting Epm Software

Best Tax Planning Software 2022 Reviews Comparison

Turbotax Home Business Cd Download 2022 2023 Tax Software For Personal Small Business Taxes

Income Tax Planner Bloomberg Tax

Cloud Accounting Services In Canada Wave Taxes Inc

Creative Planning Wealth Management Investment Services

Andersen Independent Tax Valuation Financial Advisory And Consulting Services For Individual And Commercial Clients Andersen

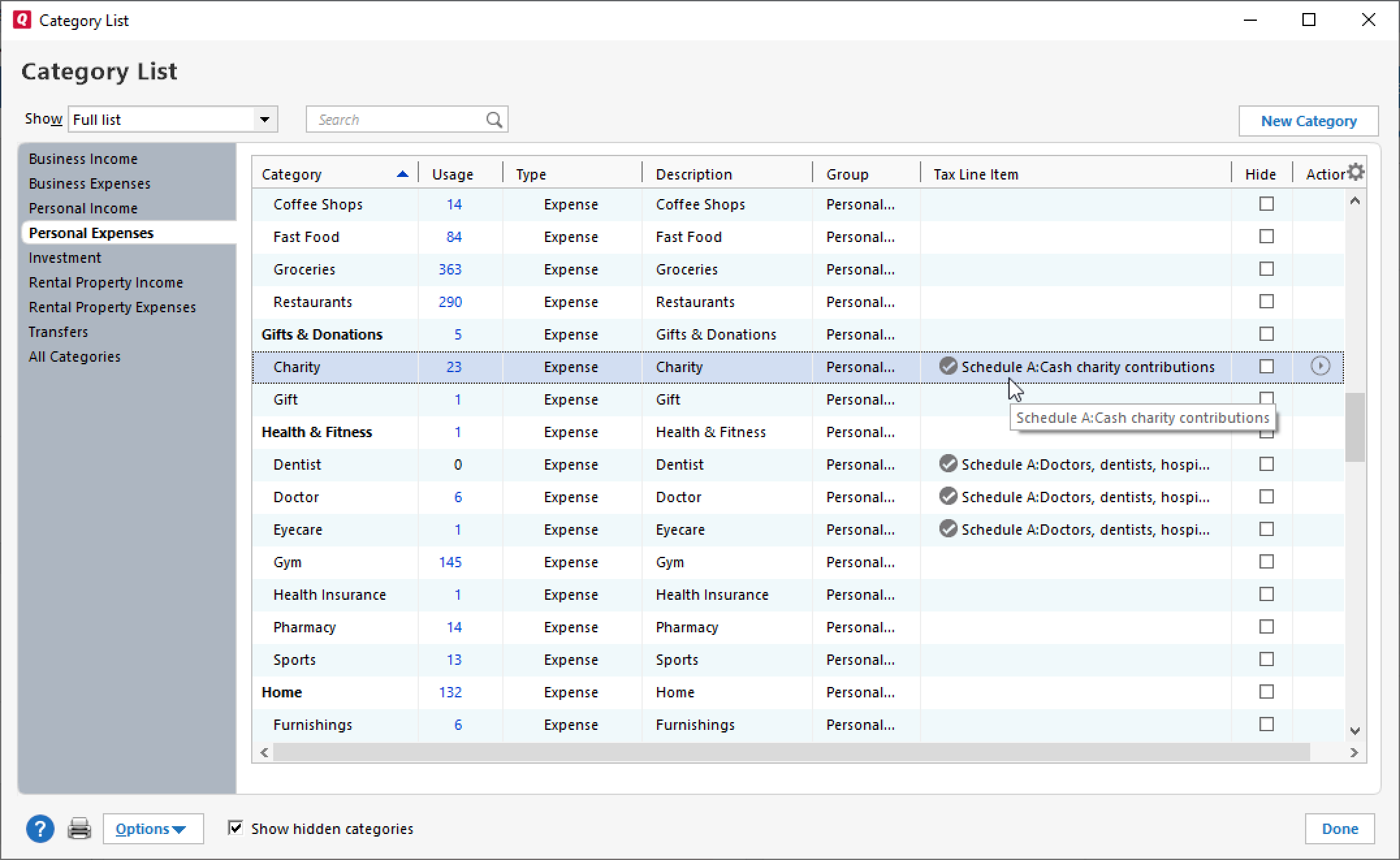

How To Make Tax Time Less Taxing With Quicken

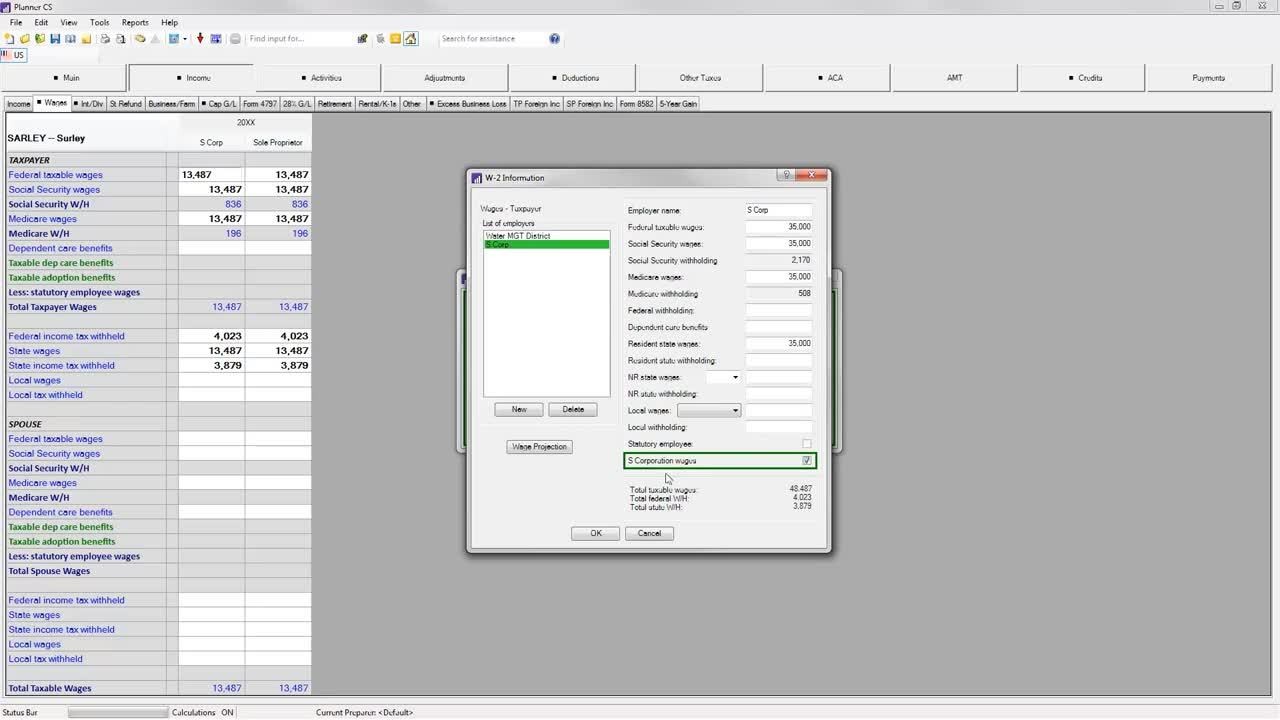

Tax Planning Software For Accountants Planner Cs

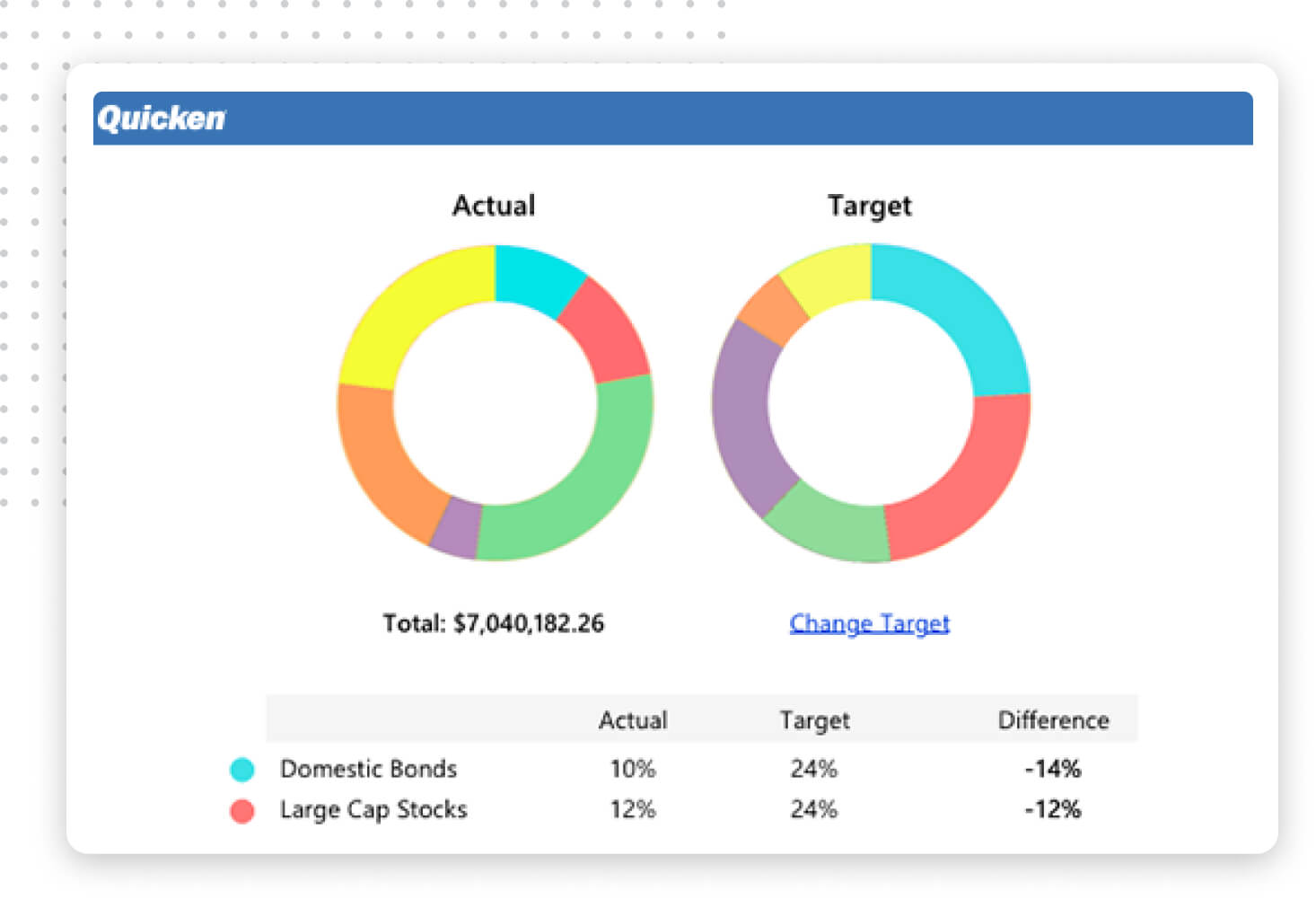

Quicken Retirement Planning Software Plan Your Retirement Today

Tax Supervisor Resume Samples Velvet Jobs

The Best Financial Planning Software For 2022 Smartasset

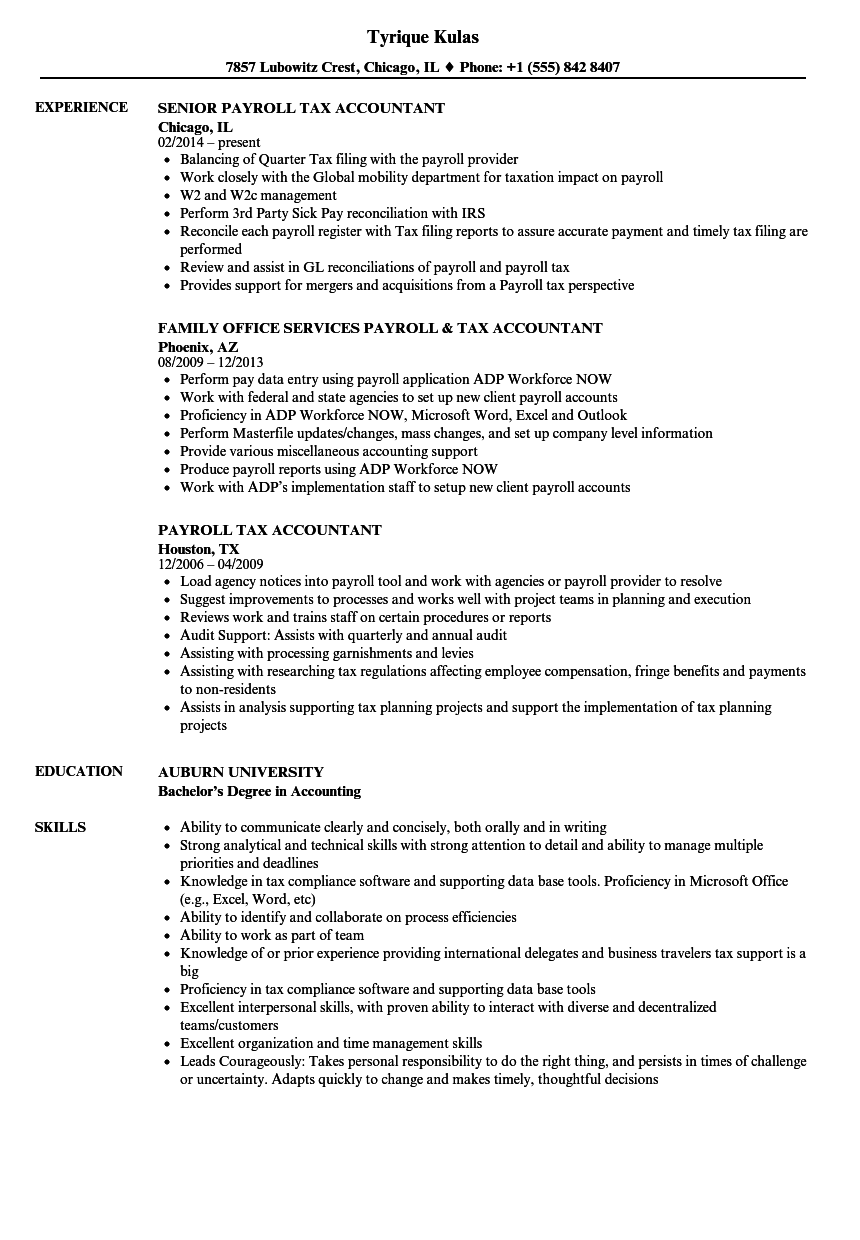

Payroll Tax Accountant Resume Samples Velvet Jobs

The Financial Planning Technology Landscape In Canada Celent